advanced tax strategies

Unlock Hidden Tax Credits

That You Already Qualify For

Without Paying 20% to a Tax Firm

Most businesses doing innovation, development, or process improvement qualify for R&D Tax Credits… but few ever claim them. TaxSmart AI automates the process your CPA needs — for a fraction of the cost.

Seamless QuickBooks Integration

Instantly syncs & sorts your transactions. New integrations launching monthly.

Smarter Questions

= Bigger Savings

Maps your data to 750,000+ tax codes for savings most won't see.

CPA-Friendly, Audit-Proof Reports

Compliant reports that save time—for you and your accountant.

Your AI Tax Expert,

On Demand

Instant answers from an always-on tax brain. No hold music, ever.

The Problem: Overpaying for What’s Already Yours

Traditional “advanced tax” teams charge 15–25% of whatever credit they recover for you. That means if your business qualifies for a $100,000 R&D Tax Credit, you could lose $20,000+ to a consultant.

These firms use the same IRS guidelines you can access yourself. They just have the staff to interpret and file them.

But what if you could use AI trained on IRS code, CPA workflows, and your own transactions to do that same analysis... Instantly, accurately, and automatically?

That’s what TaxSmart AI does.

What the R&D Tax Credit Really Is (& Why You’re Probably Missing It)

The R&D Tax Credit rewards U.S. businesses that develop, improve, or customize products, software, or processes.

If your company:

Builds or enhances software systems

Designs prototypes or tests new products

Improves internal workflows or manufacturing methods

Develops APIs, databases, or automation tools

...then you likely qualify.

The challenge? The IRS requires specific 4-part documentation to substantiate your claim.

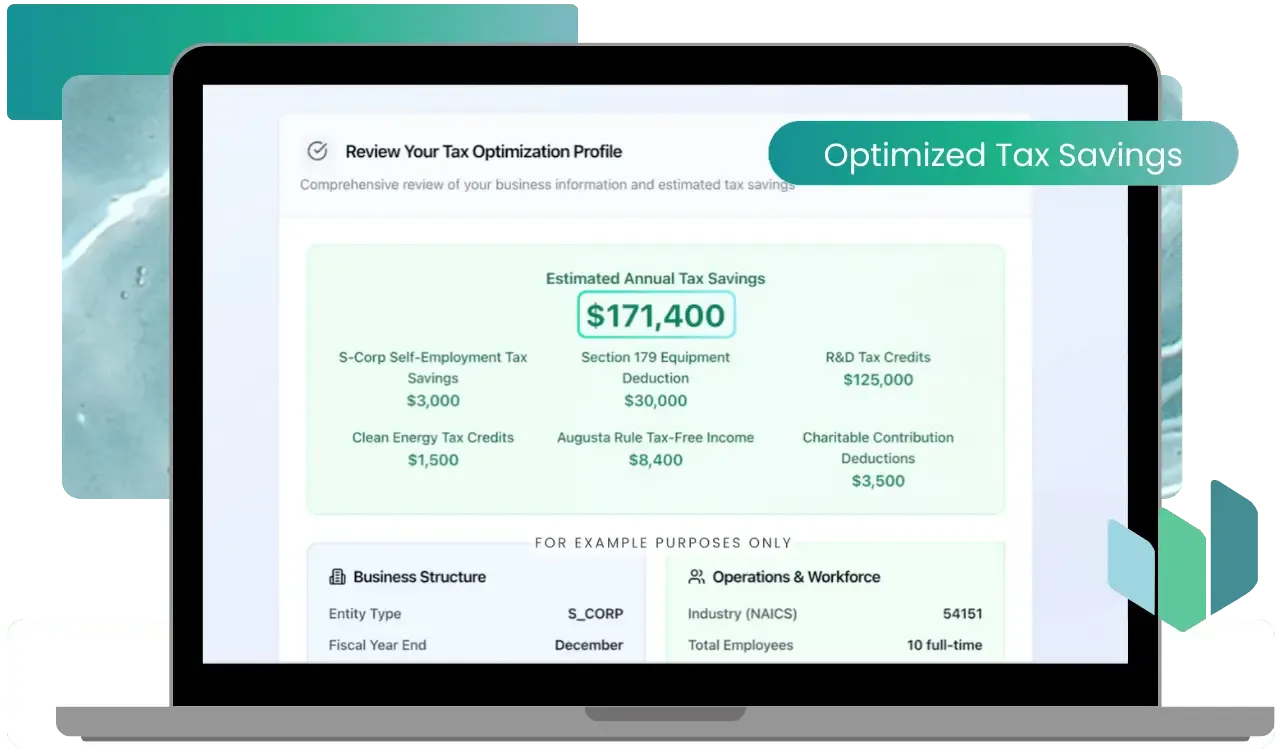

Why Businesses Choose TaxSmart AI Over “20% Consultants”

With TaxSmart AI, you keep 100% of your refund and equip your CPA with a complete, compliant package ready to file.

Traditional R&D Firm

15–25% of your refund kept as commission

Manual questionnaires and interviews

Slow process — weeks or months

Your data stored with external consultants

Focused only on R&D studies

Static analysis — billed again next year

TaxSmart AI

Flat annual fee — no percentage of your refund

AI-driven 4-part IRS compliance survey

Instant digital report for your CPA

Secure, private, and owned by you

Covers multiple credits, not just R&D

Ongoing AI learning from new tax laws

Who This Is Perfect For

TaxSmart AI is built for:

Software Companies

Enhancing apps, systems, or APIs

Manufacturing Firms

Refining workflows or machinery

Engineering Groups

Prototyping and product testing

Service

Providers

Automating internal or client tools

Diverse

Startups

Innovating across industries or tools

Even small improvements can qualify — you don’t need a full research lab.

Why You Need To Act Now

Each year you wait to claim R&D credits, you risk leaving tens of thousands of dollars unclaimed — and many credits can only be amended for the past three tax years.

Your CPA can’t complete this process without proper documentation.

TaxSmart AI gives you everything they need — in IRS-compliant format — without paying a consulting team thousands.

What Makes TaxSmart AI Different

Trusted by Founders. Approved by CPAs.

TaxSmart AI

Designed to think like a billionaire's tax team.

From encryption to documentation, every layer of TaxSmart AI is built to protect your data, your refund, and your peace of mind.

The Tax Planning Tool Built To Save You More

Audit-ready. cPA-approved.

Your Data, Your Control

Built with CPAs and Founders

Trained on 750,000+ IRS Codes

trusted by founders in all 50 states

Transparent, Flat Pricing

Built for Accuracy, Backed by Experts

"This year I owed $130K and only ended up paying $500 thanks to TaxSmart AI."

$129,500 SAVINGS

Simple. Compliant. Built to save you more.

How It Works

01. Connect Your Business

Securely sync QuickBooks or upload accounting data — no complex setup.

02. Answer AI-Guided Questions

Complete a quick IRS-compliant R&D survey built from the official 4-part test.

03. get your detailed cpa report

Receive an audit-ready report your CPA can file. With 100% of your refund intact.

Keep your refund. Automate your research.

File with confidence.

Stop overpaying for “specialists.”

Use AI to uncover the R&D Tax Credits your business deserves. And give your CPA the full report to file. Start Your R&D Credit Report with TaxSmart AI today.

connect with us

Disclaimer: TaxSmart AI is an educational technology platform, not a certified public accounting firm or a substitute for professional tax advice. The information, insights, and reports generated by this software are for educational and informational purposes only and are not intended to provide tax, legal, or financial guidance. All calculations, analyses, and recommendations should be reviewed and approved by your licensed CPA or tax professional prior to being used in any tax filing or financial decision. TaxSmart AI does not guarantee eligibility for any specific credit or refund, and assumes no responsibility for the accuracy of user-submitted data or filing outcomes.

Copyright 2025 TaxSmart AI™ | Terms & Conditions | Privacy Policy