Bring TaxSmart AI to Your Firm

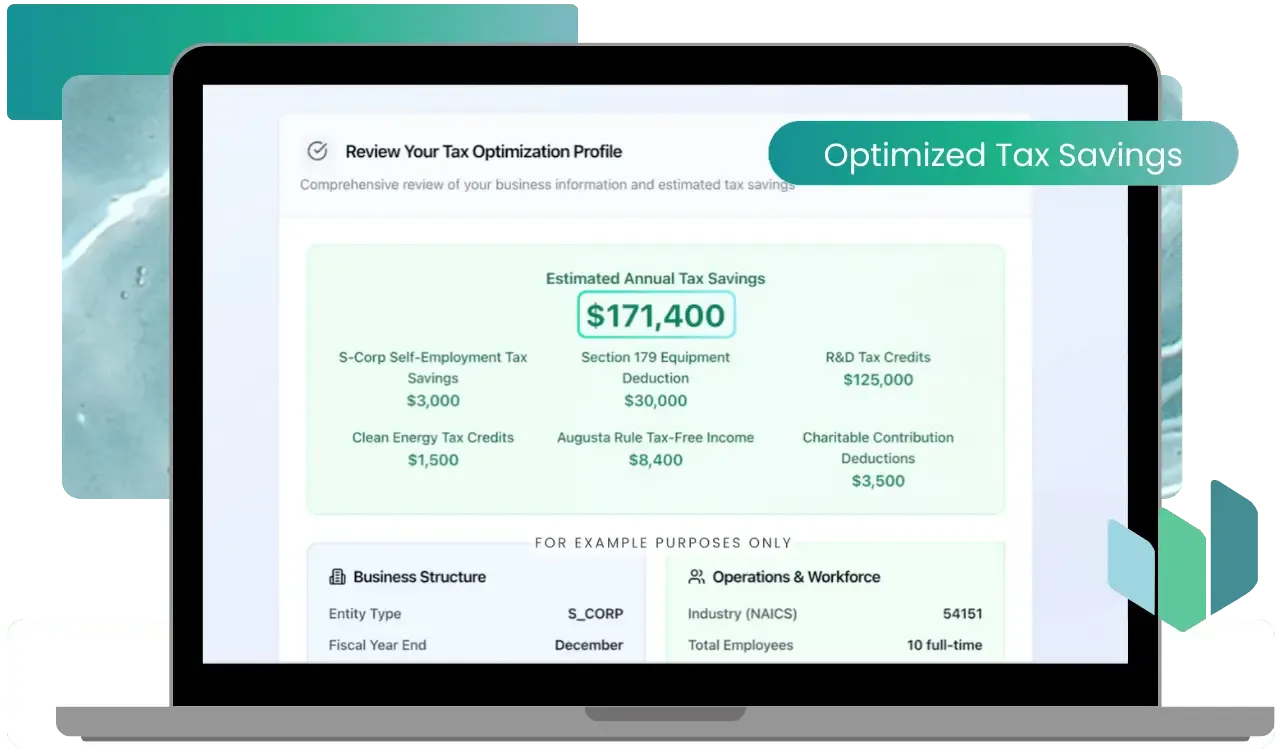

Automate Tax Credit Discovery and Client Reporting Under One Dashboard

We’re building the future of tax technology for accountants.

Manage all your clients, automate credit analysis, and deliver AI-generated IRS-ready reports, all under your own white-labeled platform.

Branded Reports. Built-In Trust.

Deliver AI-powered tax strategy under your firm’s name. No third-party confusion.

One Dashboard. Full Oversight.

Manage clients, credits, and reporting from one secure, easy-to-use dashboard.

IRS-Ready Docs. Zero Manual Work.

Auto-generate compliant reports for R&D, Energy, and Cost Segregation credits.

Flat Pricing. Full Profit Retention.

No commissions or revenue share. You retain 100% of your advisory value.

The Future of Tax Advisory Is Here — And It’s Built for Accountants

TaxSmart AI is transforming how firms identify and document tax credit opportunities. Our platform is trained on federal and state tax law, CPA workflows, and IRS documentation standards to help accountants:

Identify hidden credits across R&D, Energy, Cost Segregation, and more

Generate IRS-compliant reports for each client automatically

Streamline documentation and eliminate time-consuming surveys

Keep clients engaged year-round with real-time tax planning insights

All Clients. All Credits. One Branded Command Center.

In Q1 2026, we’re launching CPA Dashboards, giving accounting professionals complete visibility and control over all client accounts from one secure interface.

With the TaxSmart AI Accountant Dashboard, you’ll be able to:

Centralize all client activity: view progress, reports, and tax credit estimates instantly.

White-label the platform with your firm’s name, logo, and branding.

Invite your team members to collaborate and track client updates in real time.

Receive alerts and summaries when clients complete credit surveys or generate new reports.

Export IRS-ready documentation instantly — no back-and-forth or manual formatting.

No more juggling spreadsheets or outside consultants — TaxSmart AI becomes your internal AI tax team.

Why CPAs are Partnering with TaxSmart AI

Your clients deserve better than waiting for third-party consultants. And your firm deserves the technology to deliver that value efficiently and profitably.

Traditional Consulting Process

Separate files and systems per client

Weeks of manual analysis

No brand control

Consultants charge 20%+ of client refund

Scattered communication and file storage

No scalable client education tools

TaxSmart AI for Accountants

One dashboard for all clients

Instant AI-generated reports

Branded white-label access

Flat pricing, no revenue share loss

Secure, compliant cloud data

Built-in education for clients

Who This Is Perfect For

If your firm helps clients grow, we’ll help you turn that into quantifiable tax savings.

CPAs & accounting firms

managing small to mid-sized businesses

Tax strategists & fractional CFOs

offering advanced planning services

Financial advisory firms

expanding into proactive tax optimization

Multi-location accounting teams

looking to standardize processes and reporting

Your tax tech edge is about to level up.

The Smarter Way To Plan Taxes

TaxSmart AI

Designed to think like a billionaire's tax team.

Early firms joining the waitlist will have first access to the platform, input on feature development, and exclusive partner pricing for their client base.

What’s Coming in Q1 2026

Complete Smart AI Tax System

Multi-client management view

performance analytics

White-label account branding

sub-account access

AI-powered client categorization by tax credit eligibility

Report exports for R&D, Energy, and Cost Segregation studies

Role-based permissions for firm admins, partners, and staff

Affiliate and referral tracking for client acquisition programs

"This year I owed $130K and only ended up paying $500 thanks to TaxSmart AI."

$129,500 SAVINGS

SHAPE THE FUTURE OF YOUR INDUSTRY.

How to Join the Waitlist and Demo Program

01. BOOK A DEMO CALL WITH OUR TEAM.

We’ll review how TaxSmart AI can integrate into your firm’s client workflow.

02. Get Added to the CPA Dashboard Waitlist.

Receive early updates and private beta access.

03. DISCUSS WHITE-LABEL OPTIONS.

Tailor the experience to match your firm’s brand and client presentation.

Empower your firm. Educate your clients. Automate the future of tax strategy.

Be the First to Bring AI Tax Automation to Your Firm

TaxSmart AI for Accountants launches in Q1 2026 — and early partners will help shape the platform.

connect with us

Disclaimer: TaxSmart AI is an educational technology platform, not a certified public accounting firm or a substitute for professional tax advice. The information, insights, and reports generated by this software are for educational and informational purposes only and are not intended to provide tax, legal, or financial guidance. All calculations, analyses, and recommendations should be reviewed and approved by your licensed CPA or tax professional prior to being used in any tax filing or financial decision. TaxSmart AI does not guarantee eligibility for any specific credit or refund, and assumes no responsibility for the accuracy of user-submitted data or filing outcomes.

Copyright 2025 TaxSmart AI™ | Terms & Conditions | Privacy Policy