advanced tax strategies

Accelerate Your Real Estate Tax Savings

Without Paying $10,000+ to a cost segregation firm

TaxSmart AI automates the same cost segregation analysis used by engineering and CPA firms — for a fraction of the price.

Get your IRS-ready report for your CPA to file and unlock massive depreciation benefits sooner.

Seamless QuickBooks Integration

Instantly syncs & sorts your transactions. New integrations launching monthly.

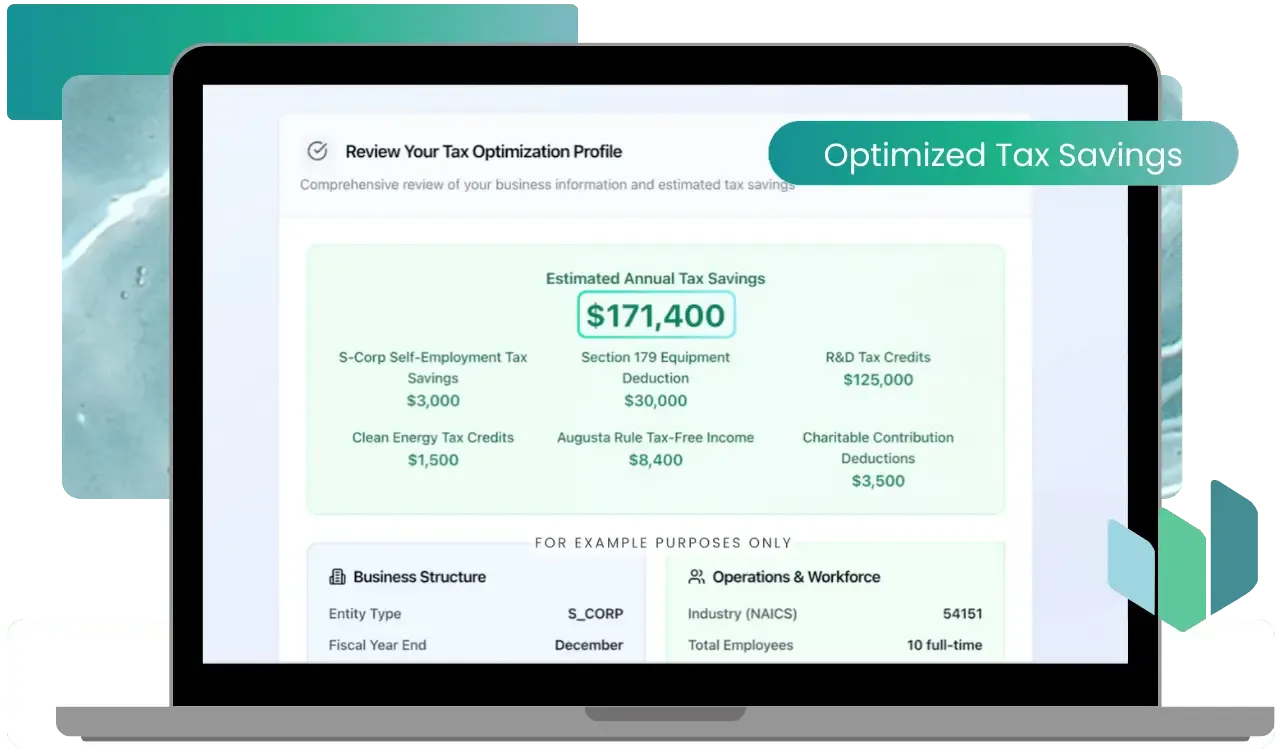

Smarter Questions

= Bigger Savings

Maps your data to 750,000+ tax codes for savings most won't see.

CPA-Friendly, Audit-Proof Reports

Compliant reports that save time—for you and your accountant.

Your AI Tax Expert,

On Demand

Instant answers from an always-on tax brain. No hold music, ever.

The Problem: Cost Segregation Firms Are Overcharging for the Same Analysis

If you own commercial or residential investment property, a cost segregation study can save you tens or even hundreds of thousands in taxes — but most firms charge $10,000–$25,000 for a single study.

They use the same IRS-approved methodology that TaxSmart AI automates: breaking down your property components (like walls, lighting, flooring, HVAC, and more) into shorter depreciation schedules.

Why pay thousands when AI can handle the calculations, classifications, and report generation automatically — at a fraction of the cost?

What a Cost Segregation Study Really Is (& Why It Matters)

When you buy or build property, the IRS allows you to depreciate it over 27.5 or 39 years. But not all parts of your building wear out that slowly.

A cost segregation study reclassifies components like:

Electrical, plumbing, and lighting systems

Carpeting, cabinetry, and millwork

Parking lots, landscaping, and signage

…into 5, 7, or 15-year property categories, allowing you to front-load depreciation and reduce taxable income now — not decades from now.

In short: you’re not changing your tax burden — just claiming what’s rightfully yours faster.

The TaxSmart AI Advantage vs. Traditional Firms

With TaxSmart AI, you get the same quality study — without paying inflated fees or waiting weeks for delivery.

Traditional Cost Segregation

$10,000–$25,000 per property

Manual engineering team & appraisers

Your property data stored externally

Slow, manual process with long turnaround

Focused only on cost segregation

Static one-time report

TaxSmart AI

Flat, affordable annual fee

AI-generated IRS-compliant report

100% data ownership — secure and private

CPA-ready documentation and classification

Covers all tax credits and depreciation studies

Continuous updates to reflect IRS changes

Who This Is Perfect For

TaxSmart AI is built for:

Real Estate Investors

Maximize depreciation on rental homes, multifamily, or commercial buildings.

Commercial Developers

Unlock early tax savings on new builds, renovations, or major upgrades.

property managers

Help clients reduce liability across portfolios you manage.

accounting firms

Deliver cost seg studies to clients — without external consultants.

small businessowners

Restaurants, retailers, and warehouse owners qualify too.

If your property is worth $250,000 or more, you likely qualify for significant accelerated depreciation benefits.

Why You Need To Act Now

Every month you wait, you lose depreciation value you could have already claimed.

The IRS allows you to go back and amend returns — but acting now means more cash flow immediately and better long-term compounding.

Plus, bonus depreciation laws are phasing down year by year.

By acting now, you can maximize benefits before the window closes.

Your CPA can’t complete this study without detailed component documentation — and that’s exactly what TaxSmart AI generates automatically.

What Makes TaxSmart AI Different

Trusted by Founders. Approved by CPAs.

TaxSmart AI

Designed to think like a billionaire's tax team.

From encryption to documentation, every layer of TaxSmart AI is built to protect your data, your refund, and your peace of mind.

The Tax Planning Tool Built To Save You More

Audit-ready. cPA-approved.

Your Data, Your Control

Built with CPAs and Founders

Trained on 750,000+ IRS Codes

trusted by founders in all 50 states

Transparent, Flat Pricing

Built for Accuracy, Backed by Experts

"This year I owed $130K and only ended up paying $500 thanks to TaxSmart AI."

$129,500 SAVINGS

Simple. Compliant. Built to save you more.

How Cost Seg Automation Works

In just a few minutes, TaxSmart AI replaces weeks of consultant work... and gives your CPA everything they need to claim your depreciation.

01. Connect Your property details

Enter key details like purchase price, address, and any renovations. No complex setup required.

02. complete our ai survey

Answer a guided questionnaire built on IRS cost segregation standards. No engineering jargon.

03. download your detailed cpa report

Receive a full IRS-compliant cost segregation study, with all classifications and references — ready for your CPA to file.

Accelerate your tax savings. Keep your cash.

File with confidence.

Stop paying $10,000+ for what AI can deliver automatically.

Your CPA needs documentation — not a consulting firm invoice. Generate your Cost Segregation Report with TaxSmart AI today.

connect with us

Disclaimer: TaxSmart AI is an educational technology platform, not a certified public accounting firm or a substitute for professional tax advice. The information, insights, and reports generated by this software are for educational and informational purposes only and are not intended to provide tax, legal, or financial guidance. All calculations, analyses, and recommendations should be reviewed and approved by your licensed CPA or tax professional prior to being used in any tax filing or financial decision. TaxSmart AI does not guarantee eligibility for any specific credit or refund, and assumes no responsibility for the accuracy of user-submitted data or filing outcomes.

Copyright 2025 TaxSmart AI™ | Terms & Conditions | Privacy Policy